WHAT WE DO

Creating a digital future

We've developed an innovative and safe payment financial solution for the future.

Trusted by popular brands

1.8B+

cheques are issued each year for businesses only, accounting for approx. 40% of the business transactions

Currently average time to clear out the cheques

1-3 days

Faster, Safe e-cheques

Replace outdated paper cheques with secure, digital E-Cheque that clear in hours, not days. Our system eliminates fraud risks, reduces processing costs, and simplifies payment flows for businesses and banks.

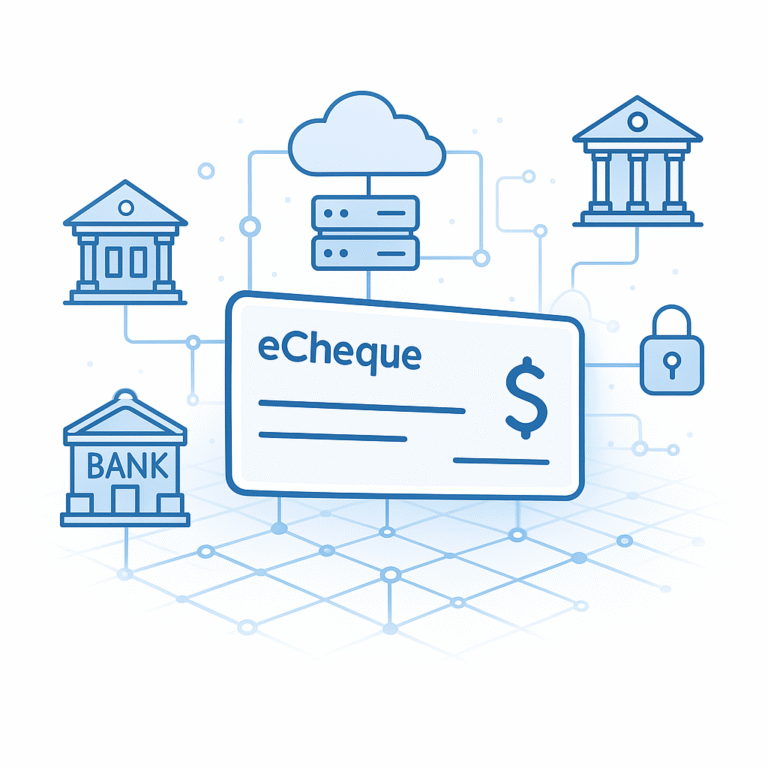

Smart Clearing House Network

Our intelligent clearing engine connects banks and businesses in real-time, automating settlements and validations. Say goodbye to delays, manual errors, and reconciliation headaches with our efficient, always-on clearing system.

- Real-Time Settlement

- Automated Validation

- Scalable Infrastructure

Bank-Grade Security,

Built for

the Digital Era

End-to-End Encryption

Real-Time Fraud Detection

Regulatory Compliance

Cross-Border Compatibility

Send and settle E-Cheques internationally with ease. Our platform supports multi-currency transactions, local compliance, and global banking networks—making cross-border payments as seamless as domestic ones.

FAQ's

An E-Cheque is a digital version of a traditional paper check. It allows businesses and individuals to send and receive payments electronically using a secure, verified process.

Most E-Cheques clear within a few hours to 1 business day, depending on the bank’s processing time and verification requirements.

Yes. We use bank-grade security, including end-to-end encryption, real-time fraud detection, and full regulatory compliance to protect your data and transactions.

Absolutely. Our platform supports cross-border transactions, multiple currencies, and local compliance to make global payments seamless.

No complex integration is needed. Our system connects securely to existing banking infrastructure and APIs to streamline implementation.

Our solution is designed for banks, financial institutions, enterprises, and fintech platforms seeking faster, more efficient check processing.

Digital verification, account validation, and AI-driven fraud detection significantly reduce risks compared to paper checks, which are prone to theft and forgery.

Pricing varies based on transaction volume and integration scope. Contact our sales team for a tailored quote and demo.

Ready to get started?

Subscribe to our monthly newsletter and get up-to date with the financial markets and latest technology.